Accelerating economic digitalization in Peru: A paradigm for emerging economies?

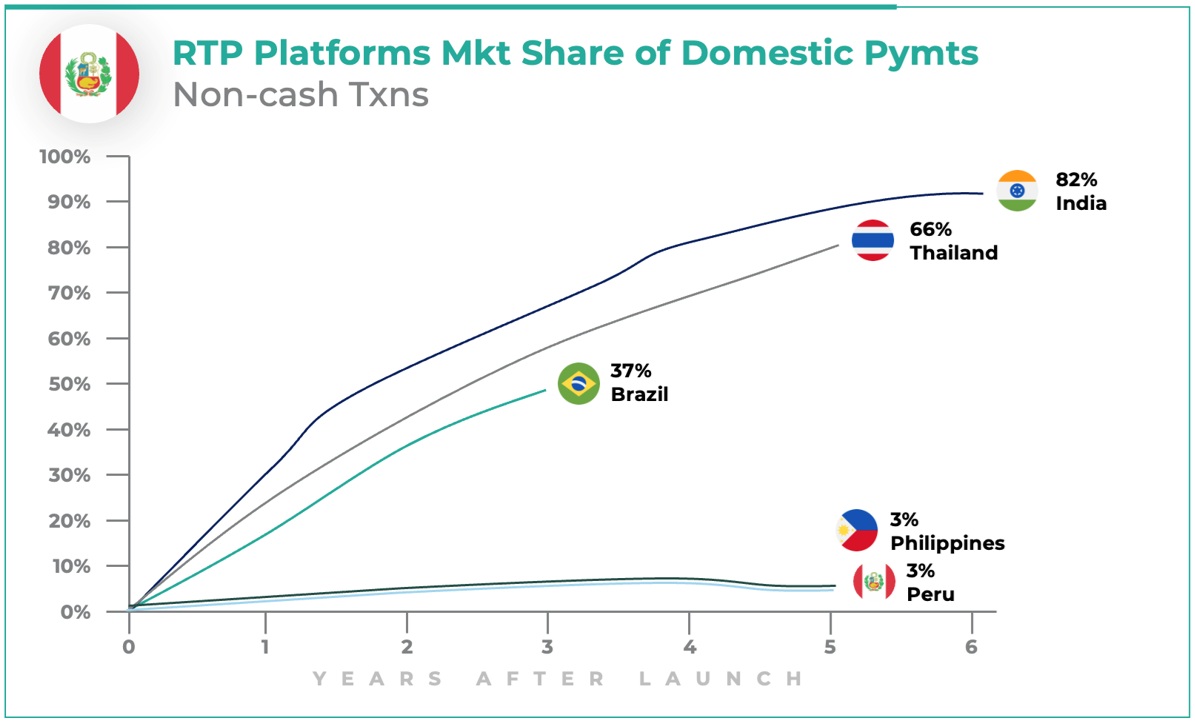

Cash use in Peru has declined at a rate similar to that of other comparable markets thanks to a surge in the popularity of bank-owned e-wallets. However, adoption of Peru’s national Real-Time Payments (RTPs) system has been slower. We examine steps Peru could take to drive RTP use, digitalize the Peruvian payments market and deliver […]

Accelerating economic digitalization in Peru: A paradigm for emerging economies? Read More »