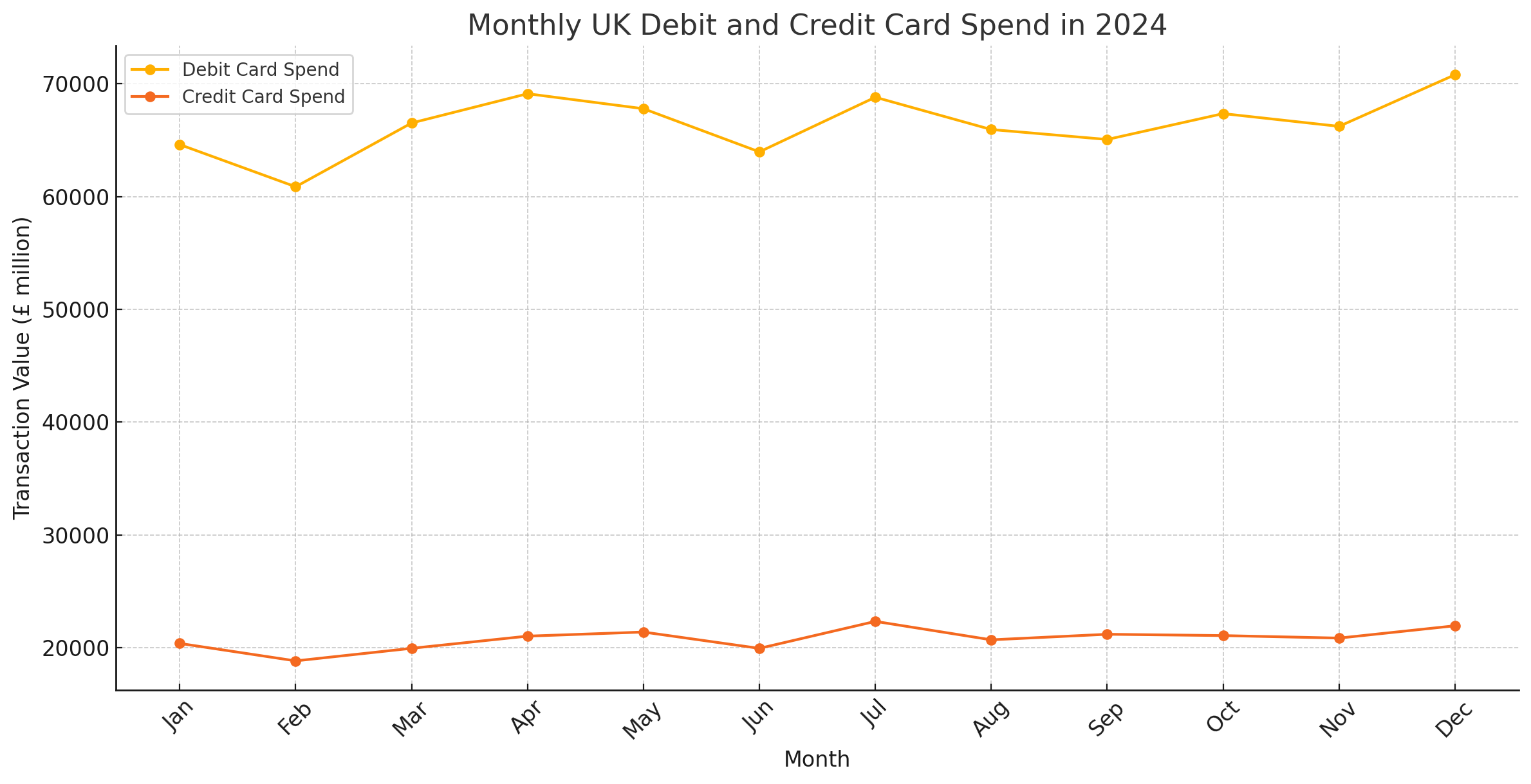

Top 10 merchant acquirers processed $10.6 trillion in 2024

The top 10 US merchant acquirers collectively processed $10.6 trillion in card volume during 2024, according to newly released data from The Strawhecker Group (TSG). The findings, sourced from TSG’s authoritative 2025 Directory of US Merchant Acquirers, shed light on a market that remains highly concentrated and increasingly defined by scale, strategic bank relationships, and […]

Top 10 merchant acquirers processed $10.6 trillion in 2024 Read More »